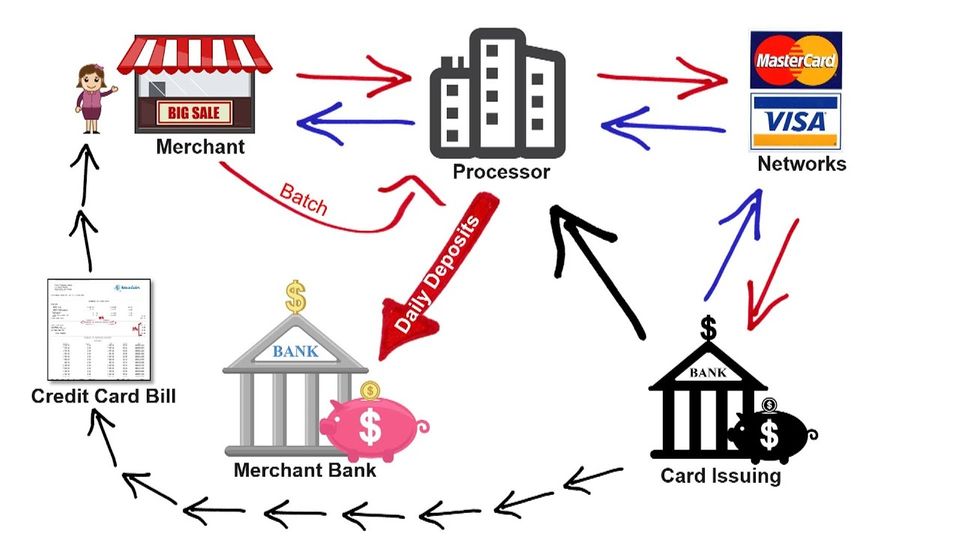

Payment processing software acts as a go-between for both the buyer's bank and the merchant's web portal. In this scenario, the purchase is processed by the merchant's bank using the customer's payment card.

It is a robust control center designed to accommodate and handle all current non-cash transactions for products and services in either company or government agency.

Rounding up Payment Gateway Software

Any time a consumer makes an online order, it seems that the procedure is really quick. This is mainly attributed to the payment gateway program doing much of the simple work for you.

Let's get a bit further into the technological aspects of payment data transmission.

When making a purchase, the customer inserts the credit card information, expiration date, and CVV code into the payment gateway section. Data is sent towards the payment gateway via data encryption network. All payment information is secured and sent to the payment processor.

In the context, the bank that authorized the card tests for the existence of available money, and the payment is accepted or denied after the bank validates it.

How Does Payment Processing Software Function?

Every payment processing software is made up of three main components:

- Merchant Account: All consumer deposits are deposited into the merchant account of your company. Though it might not be the main account where you handle your daily operations and spending, all purchases processed via your payment processing system are routed into this account.

- Money Processor: The payment service system handles the rear of the processing program and assists with connecting the business to online banking networks in order to promote purchases. They are usually in control of maintaining data integrity and coping with illegal conduct or chargebacks.

- Payment Gateway: As the name implies, the payment gateway links your retail and electronic POS platforms, as well as your merchant account, to credit card providers and authorizing banks. There is no way to share data and information between users if there is no payment gateway.

Payment gateways may only be established by companies who are either a Member Service Provider (MSP) or an Independent Sales Organization (ISO). This status means that they fulfill the necessary financial, technological, and protection standards to safely handle payment details. Payment processors should continue to follow PCI DSS protection requirements in order to retain that position. PCI DSS enforcement, developed by credit card associations, encompasses a wide variety of cybersecurity and knowledge protection standards that help reduce vulnerability and secure financial information from breach.

As a transaction occurs, retailer payment processing software goes through a sequence of measures to authorize and execute the payment:

- The POS sends the transaction data to the retailer payment gateway, which safely sends the data to the server.

- The details are sent to the client's bank or credit card system by the payment service provider (depending on the nature of payment).

- The agreement is reviewed by the issuing bank, which either accepts or refuses it.

- If the payment is effective, proceeds are issued and credited to the merchant account.

- The processor receives the authorization message, which is then conveyed to the POS via the retailer gateway.

This whole procedure only requires a few moments, although it may actually take a few more days for the proceeds to be passed to the retailer.

Understanding White–Label Payment Service Provider

The term "white–label" refers to a market strategy under which the corporation does not make its own goods but instead purchases the right to distribute it through its own name. Under this scenario, the tech company will extend the opportunity to market the service to other customers simultaneously and collect a share of the profits. To sum up, this is a modular system that enables payment service firms to profit simply from offering the solution. Myuser is a full white-label PSP offering one of the best payment processing software.

Understanding the Key Advantages of Utilizing Enterprise Applications With White Label PSP

Acceleration

Creating your own payment system will take several years and a production team. Furthermore, required permits must be issued and scrutinized on a regular basis. You can arrange transactions within a week if you use the white–label PSP system.

The Cost

The expense of developing software is large. Often funds are simply squandered. It is preferable to delegate payment collection to experts. It is more dependable as well as less expensive.

Simpleness

Payment processors' tech solutions also comprise both the integration of a payment gateway, its setup, and ongoing maintenance.

A Set of Fully-Prepared Solutions

Constant rivalry in the processing industry pushes developers to offer more innovative applications, and as a merchant, all you have to do is pick the right one. There is no reason to spend resources on quality management because virtually white label PSPs like Myuser strive to have the finest payment processing software available.

Why Does Your Company Need a Proper Payment Processing Software to Progress?

If your company intends to accept online payments of some capacity, you would need payment processing solutions. However, when choosing the best payment processor, it is critical to consider how you want your company to flourish in the long run.

Not all retailer payment processors offer a “one-stop shop” approach. Some only link current merchant accounts to their web portal, while others provide payment processing services as well as the tech integrations required to implement a POS for electronic payment transactions. This is particularly relevant for companies operating in what financial institutions refer to as "high-risk" businesses.

It may be challenging to obtain a high-risk merchant account. Essentially, being branded a high-risk business will prevent merchants from accessing flexible fee arrangements and impose onerous reserve conditions. Through choosing a payment service provider that specializes in high-risk businesses and offers customers attractive high-risk retailer accounts, you can position your business for versatile and profitable development.

Myuser is an excellent example of a dependable white-label payment processing system. Over the time, the company has developed top–tier payment processing technologies and has offered them using a white-label payment solution. There is no monthly cap or growth limits to hinder your business growth and scalability. Myuser offers instant payouts and you have a chance to get up to 2% cashback if you spend an amount through the withdrawal card provided by Myuser for free. Talk to one of our experts today and get started with Myuser!