Why do people like shopping online? Because it is simple. It is easy. And they don't have to leave their homes to purchase a single item. However, providing a convenient and fast service to a consumer is not so easy for an e-commerce store owner. Setting up a safe online payment process may be difficult because it necessitates ongoing oversight and change.

Ecommerce stores also have a range of payment solutions that charge consumers a reduced rate, accept cashless payments, and other regular payment processing features. Nonetheless, they necessitate a slew of different integrations to be stable. To top it all off, unsecured payment gateways will result in increased cart abandonment, order withdrawals, cashback, and even order failures.

Statistics on Online Store Purchases

- The global cart abandonment figure is 69.7 percent on average. This indicates that out of every 100 customers, 69 percent would exit the shop during the purchase process.

- If there are some problems with payment processing services, mobile customers are more inclined to abandon the website.

Payment Fraud

Shop owners often experience a slew of online payment concerns from payment processors while providing merchant services. In 2018, the FTC got 18 million e-commerce-related grievances. Forty-eight percent of them were linked to payment theft. The e-commerce market is changing, and as the e-commerce shop expands, you can accept more fraudulent orders. Most of these are bogus orders placed at your shop by hackers or scammers in order to exploit security flaws.

Types of Payment Fraud

Check out this list of payment fraud forms and how they can influence your business.

Friendly Fraud: Friendly fraud arises when consumers make payment card payments and then call the credit card provider to challenge the fee. These consumers also complain that they have not obtained their goods or a refund, or that they do not recall making the purchase. This method of fraud has increased in prominence in recent years, resulting in substantial losses for merchants.

Triangulation: Triangulation fraud happens as consumers make purchases from untrustworthy online retailers. After a consumer makes a transaction, the fake sellers automatically steal the buyer's credit card numbers. The buying order journey involves three parties: the buyer, the bogus online retailer, and the payment gateway. The aim of this sort of fraud is to use credit card details for personal gain or to offer it to a third party.

Clean Fraud: Clean fraud happens when a fraudster performs offenses using genuine knowledge. The thief is well-versed in the cardholder's personal information.

Identity fraud: It is a violent crime that occurs when computer hackers capture the shopper's identity. It is a substantial offense.

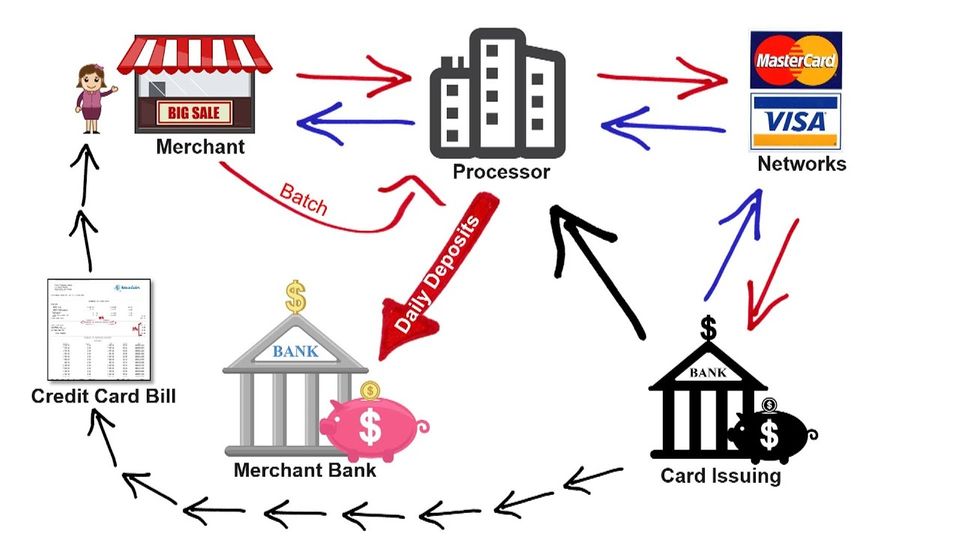

Chargeback fraud: Chargeback fraud is a theft that happens anytime a customer uses their own credit card to make an online transaction and demands a chargeback from the issuing bank after obtaining the bought products or services. If a chargeback is accepted, it cancels the financial contract and the customer gets a refund for the money expended. If a chargeback happens, the retailer can be found responsible based on the payment system used.

The Challenges of Fighting Friendly Fraud

In today's credit card transaction world, one of the most significant obstacles for e-commerce and card, not present retailers is the gradual growth of "Friendly Fraud," often recognized as the "I didn't do it" or "It wasn't me" chargeback. Pleasant theft happens when a cardholder performs a legal online or over-the-phone order, collects the products or services, and then tries to chargeback the transaction, alleging that they did not approve the transaction. Cardholders do this for a number of purposes, including wanting to buy more for free, lowering their account balance, or struggling to meet the full charge for their credit bank at the end of the month. Issuing banks also rendered the chargeback mechanism simpler and easier for their cardholders over time, resulting in an increase in friendly fraud.

Friendly fraud is a major issue for retailers since the purchases in dispute are legal and permitted. It is very complicated for the retailer to argue that the cardholder lied about approving the sale. In certain instances, it falls down to the cardholder's word against the retailer's, and in most cases, the authorizing bank agrees with the cardholder, leaving the vendor to foot the bill for chargeback payments, time and money spent to contest the chargeback, the expense of products or services, and the cost of securing the sale in the first place. For example, look at the image below to get a vivid idea:

Solution

A lot of friendly fraud can lead to a greater amount of chargebacks which can result in payment processors freezing your funds. Myuser offers a 1-4% fee over that of Stripe to have insurance that there are no frozen funds as it is done usually by Stripe. Thus, it helps high-risk merchant accounts to be in a safe margin. Friendly fraud can still take place but the damage is minimized because by using Myuser your dispute rate will decrease significantly as it will give you the same abilities as Amazon to handle disputes from your own Dispute Resolution Center without requiring customers to go to bank. However, there are still chances for people to do friendly fraud.

Chargeback

A chargeback is a much more severe concern than payment fraud. Since making an order, a buyer charges back the money to request a refund. Eighty-one percent of consumers confess to filing a chargeback, for the following reason: the commodity was shipped late or not at all. Any online shoppers say that their transactions were fake or produced without their consent or permission. This chargeback may have a detrimental effect on the store's ranking, lifting the warning flag in payment gateways and, in serious situations, causing the store to shut its doors. Just like the Stripe freeze funds for merchants due to growing dispute rate without any prior notice. Sometimes, Stripe doesn't even bother to give an explanation before freezing funds or suspending accounts. It might be due to a growing dispute rate or any other reason, the answer to which Stripe knows!

Solution

Myuser uses chargeback prevention to decrease your dispute rate significantly so Stripe accounts stay healthy and they don't add you to the Match List. Now let us disclose the risk of getting added to the Match List. Once a seller gets added to the Match List, the seller cannot engage in transacting any amount of money for five years! That's a lot! You literally cannot make money for five years and you get banned. However, Myuser helps to solve this issue with its chargeback prevention.

Credit Card Data Theft

In the United States, hackers robbed almost 14 million payment cards in 2018. This is a staggering number, and as an online shop owner, you should think of utilizing online protection tools to protect your e-commerce business. When buying a commodity from an online retailer, credit card users need not be afraid to create a purchase. You must have a secure payment gateway in order to prevent hackers from stealing vital details from your legitimate purchase.

Solution

You can safeguard the customers' payment details by incorporating:

- End-to-end protection with an SSL certificate.

- Make use of a secure third-party payment portal. Most e-commerce shop owners choose PayPal since it is popular. However, PayPal along with other payment processors like Stripe has been receiving a lot of bash from millions of users. The question at hand and undoubtedly is their inferior customer service on the market. This is where Myuser steps in.

- The best payment processors would argue about risks and literally freeze your funds in order to "handle" their risk. Myuser "handles" the danger by assisting you with proper configuration rather than locking your high-risk merchant account. Payment processing services despise fast-growing businesses, and their underwriting is not structured to benefit them. Myuser, however, helps high-growth businesses by instantly underwriting the business every hour automatically.